Hurricane Season begins June 1st, peaks in August and lasts through the end of November. Most people think of hurricane preparations as buying batteries, candles, sandbags, food and water. If only it were that simple.

The single most important thing you can do is to insure your home. There’s a catch, though. You cannot wait until the mother of all storms is barreling straight toward your largest investment. You must buy the insurance while there isn’t a single storm Inside the Box.

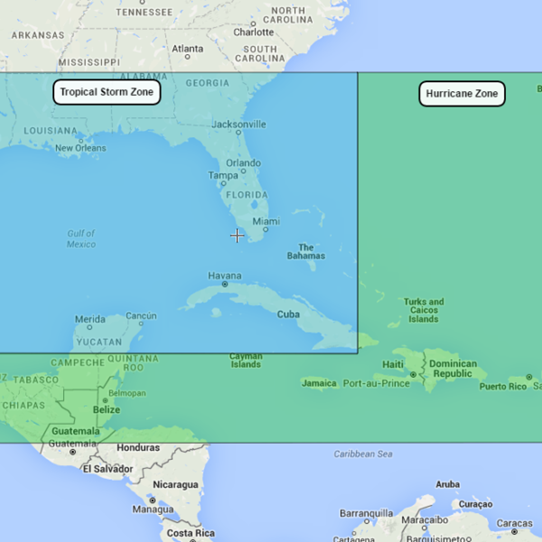

As of this writing, there are no named storms in the Atlantic. If a Tropical Storm or Hurricane enters “the box,” an approximately 16,000 sq. mile area extending over Florida, the Atlantic ocean and adjacent states, your window of opportunity to properly insure your home will slam shut quite abruptly.

You’ll want to address every item on the TBR Property Management Seasonal Checklist:

- Homeowner’s Insurance

- Flood Insurance

- Wind Insurance

- Liability Insurance

- Collections Insurance

We do not sell home insurance. This is done for the benefit of our clients, and shared for the benefit of all.

Here is a brief description of the coverage you will need.

Homeowner’s Insurance covers your Dwelling, Personal Property, Loss of Use, Personal Liability and Medical Payments. This is a basic and essential insurance. Pro Tip: To facilitate any claim and save yourself a lot of headaches, take photos of your valuables and of your property from every angle, and email them to yourself so you can access them any time, anywhere.

Flood Insurance covers damages to your property due to flood. In South Florida, many areas are designated flood zones. Please be aware that you property’s proximity or distance from the ocean or canals or any body of water has very little bearing on this distinction. As such, the need for Flood Insurance is as basic as the need for oxygen. Flood also covers the dreaded Storm Surge. Remember, water carves valleys into mountains. Your home, no matter how costly, is easy pickings.

Wind Insurance covers damages to your property due to wind. Tropical Storms as well as Hurricanes and Tornadoes are wind events. Fallen trees on cars and homes can cause severe damage. Similarly, flying objects such as coconuts, construction materials, street signs and anything else the wind picks up can wreak havoc upon your property. You think that taking care of your own property is enough, but you need to take others around you into account.

Liability Insurance covers everything else that the above detailed insurance policies may not. It’s an additional protection of your assets, should someone decide to sue you. Liability can be partially covered by your standard homeowner’s insurance policy, but as a separate policy, it is an added protection for your assets.

Collections Insurance covers your fine art and jewelry. For an accurate quote, you will need an appraisal and a report for both.

As mentioned, this is a brief description of basic insurance for your property, and while we are not insurance professionals, we have witnessed the damage and seen the stress and exorbitant cost incurred by homeowners who did not have adequate coverage.

For comprehensive information, you must speak to an insurance professional. If you need a recommendation in South Florida, TBR Property Management will provide you with the names and numbers of those we’ve vetted.

While we cannot prevent storms or hurricanes, we can prepare to the best of our abilities. Insurance is part of that. Please take advantage of our practical guide, and protect your properties.